Hospital chains may not be able to fix health economies with major structural issues, so what benefits might they deliver?

The Dalton review is looking at hospital chains as potentially providing a solution to the problem of variable clinical/managerial quality and increasing deficits.

Chains may generate a competitive advantage over standalone organisations due to:

- economies of scale such as bulk buying;

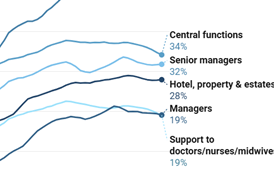

- application of managerial expertise through economies of scale allowing higher quality managers, and through dissemination of “what works” through standard operating procedures;

- brand loyalty or confidence increasing volumes;

- aarket share allowing a stronger negotiating position;

- channelling of patients in the network to increase volumes and avoid service duplication; and

- easier access to capital and other key resources.

This article concentrates on the first two, as the others are more relevant to private healthcare – although they are not irrelevant to the NHS. They also serve as a warning that experience with chains in countries such as the US may not necessarily apply to the NHS.

Finding what works

Arguably the most important feature of chains should be the systematic dissemination, application and enforcement of “what works”. Considerable autonomy on other matters can sit alongside this.

‘The NHS has struggled to disseminate a body of knowledge about how to manage healthcare across its constituent parts’

Each hospital typically has a clear structure and a manager ultimately accountable for the operation. One is not stuck (as in many trusts that operate two or more hospitals) vainly looking for someone in charge.

Conceptually, the difference between a group of facilities operating as part of a chain, and a loose conglomerate of organisations operating under the collective banner of a ‘holding company’, is that in the former, core processes will be undertaken in the same way in all facilities to deliver a targeted level of efficiency/productivity.

The NHS has struggled to disseminate and install a body of knowledge about how to manage healthcare across its constituent parts. Talk about successful organisations has tended to focus on the attributes of individual chief executives.

The supposed abilities of a chief excutive or team “coming to the rescue” have figured heavily in mergers and acquisitions. Often this has proved to be a chimera. Current success may be bound up with the organisation they operate in. For example, the team have been in situ for years and know the trust dynamics very well. This is of little consequence in determining their success in running a larger organisation, some of which will be in a different location.

The key questions are:

- Do they know (in detail) why things operate well in their own organisation?

- Is it replicable?

- Do they have the ability to replicate it?

What is required of a top team operating a chain is to establish a network where, in general, the individual components can operate without their personal supervision – not least because geography doesn’t allow it.

‘Hospital chains are unlikely to fix health economies with major structural issues’

Those aspiring to establish a chain have to know what their current organisation is good at – and why. This is not an attribute found in abundance in the NHS.

Creating the managerial “bandwidth” to establish a chain on these lines will be a considerable challenge, even for the largest trust. The investment – both human and capital – is considerable.

A complicating factor in establishing chains is that the average NHS hospital is bigger than its counterpart in the US or Europe. The complexity of the task is greater, as is its impact if it fails to deliver the expected benefits.

What benefits might hospital chains deliver, and what expectations are likely to be disappointed? Hospital chains – whatever the level of expertise available and regardless of their purchasing power – are unlikely to be able to fix health economies with major structural issues.

Holistic view

Commentators such as the King’s Fund have highlighted the importance of whole-system solutions. Whether a whole-system solution will be forthcoming is open to question, but the introduction of a hospital chain per se is not a whole-system solution.

‘Enthusiasm for hospital chains waxes and wanes as policymakers search for less radical mechanisms’

With the most challenged hospitals, a sober assessment of what can be achieved, and the risks and effort involved, will most likely result in a lack of interest from those in a position to establish chains.

Given the capital requirements associated with the dubious pleasure of owning just one site, it makes sense to create chains through the granting of time limited management franchises/licences. Even then, a look at the accounts will probably result in demands for additional funding.

The above sounds familiar because it is. Enthusiasm for establishing hospital chains waxes and wanes in part as policymakers search, and fail to find, less radical, less complex and uncontroversial mechanisms to deliver the same results.

Are these alternatives fit for purpose? M&As between neighbouring trusts have a generally undistinguished history.

More recently we have the “buddying” of trusts in trouble with a (supposedly) strong partner often many miles away. Some of the above observations about what is needed to make chains work also apply; but the ‘buddying’ idea seems to epitomise the half measures that got much of the NHS provider community into difficulties in the first place.

Dr Robert Royce is an independent healthcare consultant

1 Readers' comment